Receptive Capital Blog

Opinions and updates on the East Coast cannabis markets.

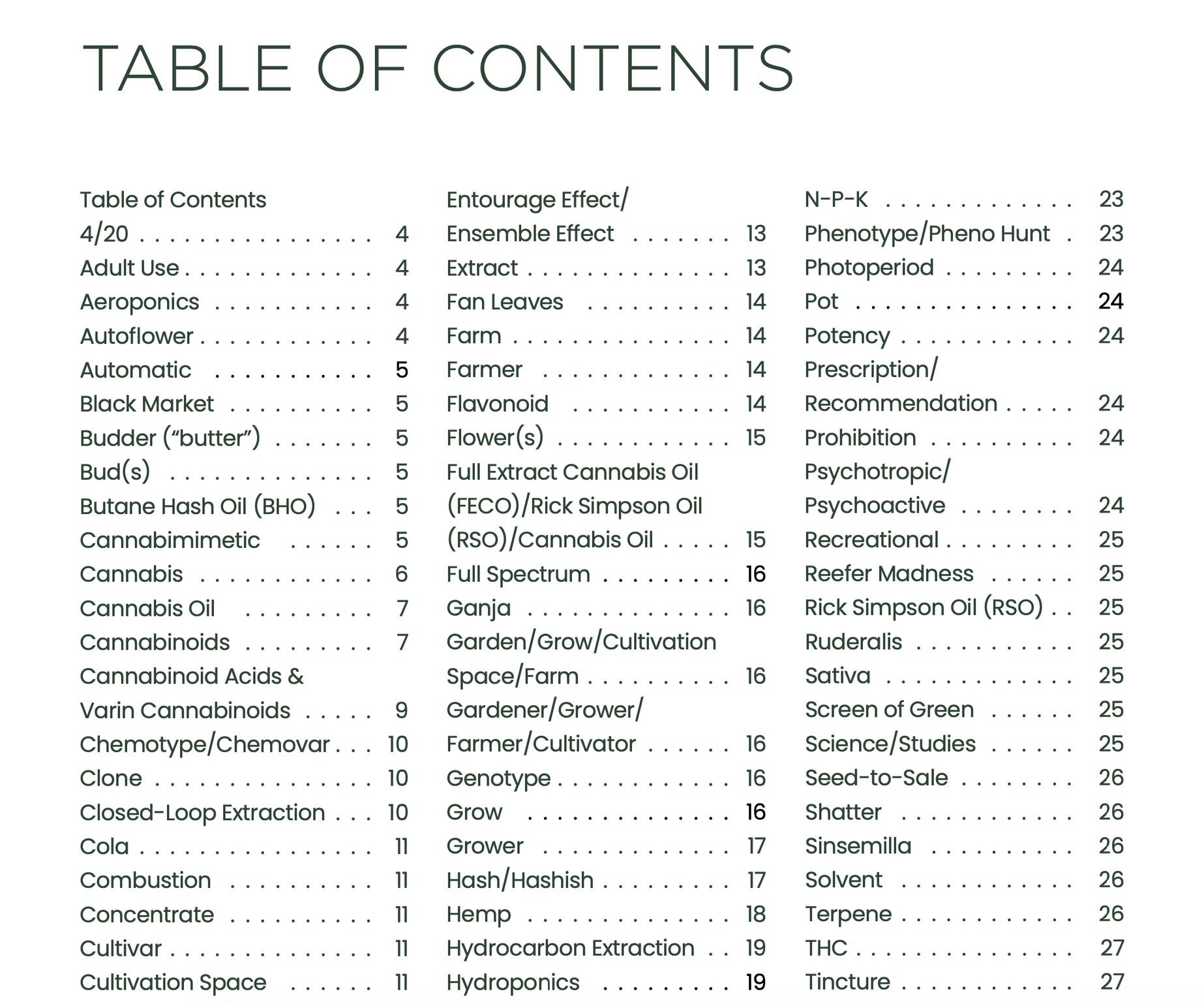

The Cannabis Terminology Style Guide

When you join the cannabis industry, the terminology is pretty daunting. The good people at Oaksterdam University have created a very useful tool called the "Cannabis Terminology Style Guide". This style guide is designed for use in academia and by any journalist, reporter, writer, or public relations professional.

When you join the cannabis industry, the terminology is pretty daunting.

A mixture of new words, slang, chemical compounds and more can make it a bit difficult to keep up. And while many in the industry are happy to answer newbie questions, interrupting a discussion (and potentially effing up the rotation) is not always possible. I've been operating, researching and investing in the industry for over 7 years now and when I attend cannabis events, I am very often jotting down a word or two I hear in conversation that I don't know so I can look into it later.

Part of the solution for me has been to stay curious and surround myself with people who have been in the game much longer or focus on an area of the business that I don't. But another part of the solution is quite simple. Find credible sources and sticking with them. Google searching cannabis terminology and data might be helpful. Other times it can lead to more confusion given the treatment of content that includes the word cannabis.

The good people at Oaksterdam University have created a very useful tool called the "Cannabis Terminology Style Guide". This style guide is designed for use in academia and by any journalist, reporter, writer, or public relations professional and that's good enough for me. I highly suggest checking it out and bookmarking it.

New Trainings and Certifications from Vangst, Trym and More

We get real excited when two industry pioneering companies come together to create trainings and certifications to level up the cannabis workforce.

Step by Step Process of How Our Syndicate Works

Here is a step by step process of how an investment is completed through the Receptive Capital Syndicate.

When you become a member of the Syndicate, you're under no obligation to invest in any deals. You are only showing interest in receiving information about the deals and committing to keeping any information you receive confidential.

The Syndicate Lead invites members to participate in or pass on any given deal. The Syndicate members pool capital into a special purpose vehicle (“SPV”) that invests in a single company alongside the Syndicate Lead, on a deal by deal basis.

Here is a step by step process of how an investment is completed through the syndicate.

Syndicate Lead leads ongoing sourcing and evaluation of investment opportunities.

Syndicate Lead completes necessary due diligence and secures allocation from the target investment company.

Syndicate Lead sends an Investment Memo to the Syndicate.

Syndicate members review the materials and decide whether or not they would like to participate.

If a Syndicate member chooses to participate, they make a non-binding commitment to invest in the SPV.

Once commitments meet or exceed the allocation from the target investment, the opportunity is closed to the syndicate.

Shortly thereafter, those members who participated in the SPV will receive closing documents for review.

Participating Syndicate members review and agree to the closing documents and wire funds. The investment is now complete.

Sounds like a lot of work? Receptive Capital provides administration services including document review, signature and investment management.

Have more questions?

Who I Am and Why I Launched the Syndicate

I’m Rick Bashkoff, Managing Director of Receptive Capital. Prior to joining the cannabis industry, I held senior positions at one of the largest record companies in the world, a pioneering media tech startup, an enterprise SaaS company in growth mode and an early stage cannabis tech company. I specialize in building long-term, mutually beneficial partnerships and I’m highly skilled in the creation and execution of a wide variety of business models and business plans. Throughout my career I have been an active investor through personal investments focused on technology, CPG, cannabis and crypto.

I’m Rick Bashkoff, Managing Director of Receptive Capital. Prior to joining the cannabis industry, I held senior positions at one of the largest record companies in the world, a pioneering media tech startup, an enterprise SaaS company in growth mode and an early stage cannabis tech company. I specialize in building long-term, mutually beneficial partnerships and I’m highly skilled in the creation and execution of a wide variety of business models and business plans. Throughout my career I have been an active investor through personal investments focused on technology, CPG, cannabis and crypto.

A lifetime cannabis enthusiast, I have served as a cannabis information resource for my family and friends for decades. What began as light conversation and cannabis stigmatized jokes at my expense, started to turn into impactful conversations as my friends and family began understanding the benefits of the plant.

My “cannabis will be everywhere” moment was in the summer of 2016. I began researching and investing in the cannabis industry as a passion project. This initial research effort quickly turned into a transformative career change. I began volunteering for CannaGather, the largest cannabis meetup in New York, working directly with the founder and team to organize the monthly meetups. I then worked as a cannabis-focused entrepreneur in residence at Five Four Ventures, a venture capital firm in New York. Following my time at the VC firm, I began consulting directly for cultivators, brands and technology companies in the cannabis industry. Leveraging my extensive network and operations and business strategy experience, I assessed business plans with a focus on revenue growth and fundraising. In July 2021, I joined Lucid Green as an SVP and GM of two of their business units.

Over the past 5 years I’ve enjoyed getting to know the cannabis entrepreneurs of today’s successful companies and I want to do more for the next generation of cannabis entrepreneurs. After building a resourceful network in the cannabis industry and seeing an opportunity to invest in early stage cannabis companies, I’ve organized a group of early stage investors as a vehicle to do more for cannabis entrepreneurs on the East Coast. The West coast states have acted as trailblazers and there is much to learn from the pioneers from the industry. However, the East Coast presents an undeniable opportunity to “do cannabis right” and I hope to be part of the effort to create a robust, inclusive and innovative cannabis industry in the East Coast states.